Table of Contents

When I was an IA, and later working at a regional property insurance carrier, I learned that bringing in home insurance leads was one of the fastest ways to grow my book of business.

Tip: Build your relationship with builders and developers to get builder’s risk referrals. You’re more likely to win the home insurance when the build is done.

Securing the home policy most often opened the door to everything else—auto, flood, toys, even life insurance. It’s the starting point for building long-term, multi-line client relationships.

But writing the policy is just the beginning. When you pair it with a well-crafted email nurture sequence, you stay top-of-mind and build lasting client relationships—automatically.

This is the same strategy we now use at Go Stack Media to help our clients consistently convert exclusive, high-quality home insurance leads into loyal policyholders.

If you’re ready to bring in more traffic, generate better leads, and build a system that runs without you chasing every sale, we can help. Let’s talk.

In this article, I’ll walk you through the exact approach we use to drive sustainable growth for agencies just like yours.

3 Key Takeaways

- Home insurance leads are the gateway to long-term growth.

Writing the home policy creates natural opportunities for bundling and building high-lifetime-value client relationships. - Success depends on timing, targeting, and follow-up.

Align your marketing with the buyer’s journey, automate your follow-ups, and tailor your messaging to drive real conversions. - Lead quality matters more than quantity.

Whether you’re generating leads organically or buying from vendors, focus on exclusive, high-intent leads. Build systems to track and scale what works.

Why Home Insurance Leads Are the Key to Sustainable Growth

Home insurance is often the first product that sparks a long-term relationship with a client. Once you’ve earned trust on the home policy, it becomes easier to bundle in auto insurance, flood insurance, or life insurance.

These clients tend to have higher lifetime value and better retention—because you’re not just selling them a policy, you’re becoming their go-to resource for coverage.

Where Insurance Agents Miss:

Many agents focus on chasing volume through quick, one-off policies. But without a strong relationship builder like the home policy, cross-selling becomes harder and retention suffers. Home insurance isn’t just a product—it’s a strategic growth tool.

Understand the Buyer’s Journey: Timing Is Everything

The most successful insurance agents design their lead generation strategy around the buyer’s readiness. Most insurance consumers in one of three buying stages.

- Awareness – They’re just beginning to learn about coverage needs. They want information.

- Consideration – They’re comparing quotes and weighing options.

- Decision – They’re ready to speak with someone and make a purchase.

Create a message that meets prospects where they are. Educational blog posts, clear quote forms, and relevant FAQs all help support each stage in a way that builds trust.

Stuck for content ideas? Survey your team. Find out the top 10 asked questions related to home insurance.

Where to improve:

It’s easy to treat every lead the same, but doing that will lead to poor timing. Sending a quote too early or failing to follow up at the right moment causes many promising leads to disengage. Timing your outreach with intent is a winning strategy.

Turn Traffic Into Quality Home Insurance Leads

Your website should do more than look good. It should guide new visitors toward becoming leads. Start by optimizing for local and long-tail keywords related to home insurance, such as “best home insurance for new homeowners in [city].” Create content that addresses specific questions and concerns your target audience has.

Make sure your content pages are simple, focused, and clear. Include fast quote forms, visible calls to action, and elements of trust like testimonials, badges like Trusted Choice and reviews.

Where to improve:

Agency websites sometimes lack clear conversion paths. If your site isn’t ranking or converting, you could be losing leads to competitors who offer a faster or more helpful online experience.

Stay Top-of-Mind With Automated, Targeted Email Campaigns

Not all leads convert on the first interaction. That’s why automation matters. Use a lead magnet like a contents inventory checklist to capture email addresses, then build segmented campaigns that speak directly to their needs—whether they’re homeowners, renters, or shopping mid-renewal.

With automation, you can deliver helpful content consistently, follow up at the right time, and create opportunities for upselling and cross-selling over time.

Where to improve:

Agents sometimes rely on one-off follow-ups or generic email blasts. Without personalization or timing, leads go cold and potential sales are lost. Automated, targeted sequences can keep your agency top-of-mind for when your potential client is ready to buy, without extra effort.

Smart Paid Advertising Strategies for Home Insurance Leads

Use online advertising to capture buyers with immediate intent. Start a Google PPC campaign. Layer in Meta lead ads to attract new homeowners or users relocating to your area.

Retargeting ads are good for re-engaging website visitors who didn’t convert the first time. Track performance and optimize based on the best-converting audiences and creatives.

Creating targeted ad campaigns is very nuanced and hard to get right without throwing money away. It really does take a practiced hand to get it right. We manage small to large ad budgets where the return on ad spend (ROAS) is 2:1 in most cases.

pro tip: Boosting is not a strategy.

Buying Leads? Focus on Quality, Not Just Quantity

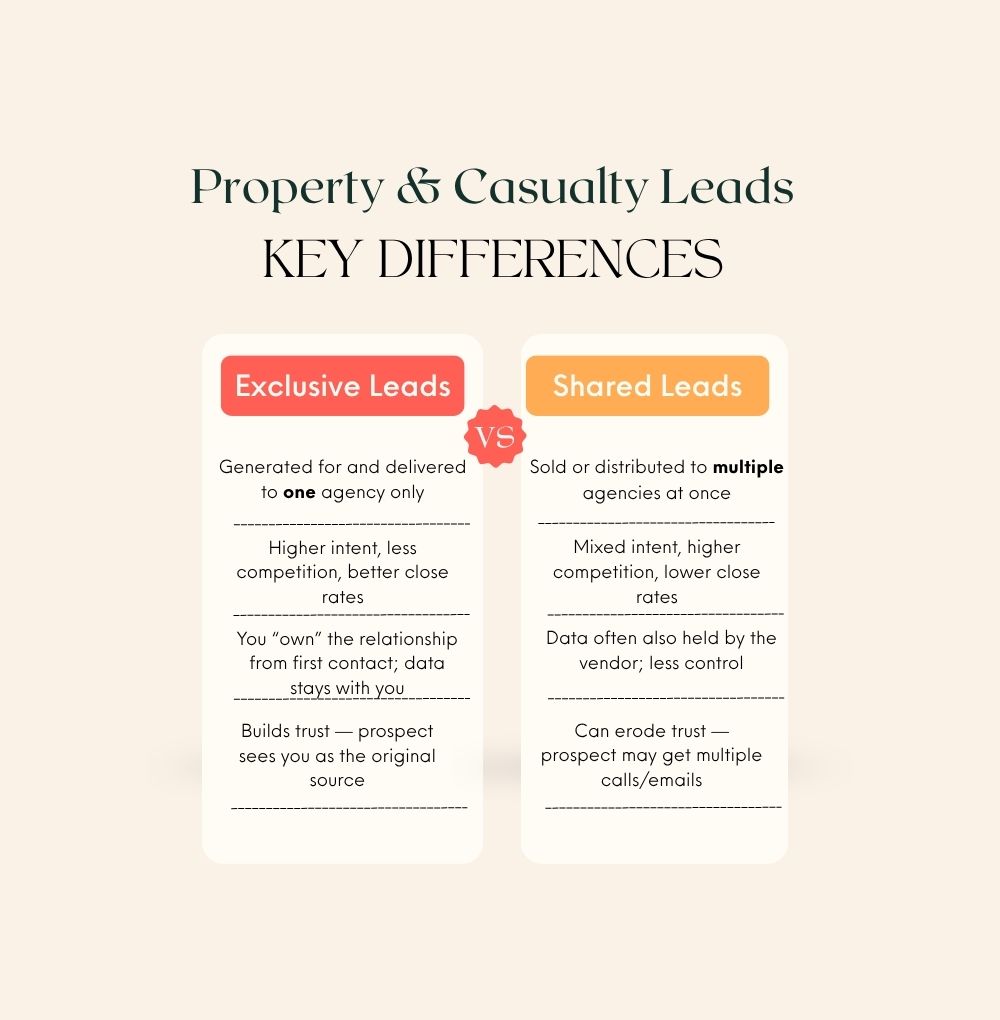

If you’re working with insurance lead vendors, prioritize lead quality over volume. Ask questions about how leads are generated: Are they exclusive leads? Are they real-time vs. aged insurance leads? Can you filter by geography or intent?

Look for vendors with transparent processes and clear return policies. Evaluate results regularly, not just lead counts.

How to get insurance leads for free

Don’t Do This:

Insurance agents feels stuck and buy from lead aggregators that deliver outdated or oversold contacts. Without filtering, follow-up support, or accountability, these leads rarely convert—and leave agents frustrated. Know your vendor and your metrics.

Build Long-Term Relationships That Drive Referrals and Renewals

A written policy is just the starting point. Keep clients engaged with regular follow-ups via email marketing campaigns. Offer value through seasonal tips, policy reviews, and reminders (be careful about reminders. You could end up in E&O jail).

Use this as a natural moment to educate about additional coverage types or discounts available through bundling.

Referral requests, when timed right, can open new doors. Build systems to consistently request reviews and referrals after positive client touchpoints.

Where to improve:

Some agents treat the sale as the finish line. Without post-sale engagement, clients may leave at renewal or miss the value of bundling. Long-term success depends on nurturing relationships, not just closing deals.

Create a Lead Generation System That Scales

To scale effectively, you need systems. Use a CRM to track lead types and lead quality, from source to sale. Combine SEO, paid lead generation, and email nurture campaigns into a unified process—and review performance regularly. Identify what’s working, cut what’s not, and refine as you go.

As your system improves, so does your ability to generate high quality leads without working harder.

Where to improve:

Don’t rely on inconsistent tactics or manual tracking. That makes it nearly impossible to scale. Without a centralized system, valuable leads fall through the cracks and marketing becomes guesswork.

Ready to Turn More Home Insurance Leads Into Clients?

Generating home insurance leads is just the beginning. Turning them into long-term, high-value clients takes strategy, consistency, and the right systems.

From understanding the buyer’s journey to building a scalable lead generation process that runs automatically, each step you take improves not just your close rate but the overall health of your agency.

At Go Stack Media, we help insurance professionals like you attract the right traffic, convert more leads, and build lasting relationships through smart digital marketing. If you’re ready to stop guessing and start growing with a proven strategy, book a call. We’ll help you build a lead engine that works—so you can focus on writing more policies and growing your business.

Not ready to connect? Join our community! Get a free email template plus marketing tips for your insurance agency- directly to your inbox every month.

FAQ: Common Questions About Generating Home Insurance Leads

What’s the best way to generate home insurance leads for agents?

A combination of SEO, email automation, and paid ads—plus working with trusted lead providers when needed.

Are insurance lead generation companies worth the investment?

Only if they offer exclusive, real-time, high-quality leads and clear ROI tracking.

Should I use lead companies that offer aged leads or real-time leads?

You should generate your own lead campaign so that your leads are not only real-time leads but also quality leads. Buying insurance leads that are aged leads can work if you have a strong nurture system in place.

How do I know if my lead sources are working?

Use conversion tracking and CRM data to evaluate lead performance over time.

How often should I follow up with leads?

Immediately at first, then consistently over the following days and weeks with relevant, helpful content.