Table of Contents

Updated: August, 6, 2025

Insurance agents, particularly independent insurance agents, rely on trust-based relationships. An effective email marketing strategy—specifically insurance email marketing—delivers information of value to policyholders, potential customers, reinforcing your role as a helpful resource.

This data‑driven approach not only supports customer retention but fuels business growth.

Need help creating high-impact email campaigns? Go Stack Media specializes in email marketing for insurance agencies—strategy, automation, and results-driven design.

One of our clients consistently sees a 43% open rate and a steady stream of quote form completions each month—all driven by email. Let’s build your next campaign.

Key Takeaways

- Email marketing is one of the most cost-effective tools insurance agencies can use to retain clients, generate leads, and stay top of mind with policyholders.

- The right email marketing strategy combines automation and relevant content to drive higher open rates, more quote completions, and stronger client relationships.

- Go Stack Media helps insurance agents achieve above-industry engagement, with clients seeing 43% open rates and steady increases in monthly quote form submissions.

How to Create a Successful Email Marketing Strategy

1. Choose the Right Email Marketing Platform

Evaluating email marketing software and email service providers—from Constant Contact to Mailchimp or industry-specific tools—is the first step. The right email marketing platform should integrate seamlessly with your customer relationship management system (or agency management system) and support email automation, segmentation, and reporting. EZ Lynx, Applied and Salesforce can all be integrated

→ Your email platform helps gather valuable insights on click-through rates, opens, and conversion rates, so your marketing campaigns improve over time.

2. Build a Quality Email List

Use sign up forms on your website and training events to grow a list of insurance clients and existing customers who opt in. Be mindful of the CAN-SPAM Act: always confirm permission before sending promotional emails or marketing emails to avoid landing in spam folders.

3. Is it Necessary to Segment Your Audience?

No. You can tailor your email campaigns for different groups—new leads, commercial insurance clients, or specific policyholders, like homeowners—using data from your CRM. Targeted content is said to boost engagement and enhance campaign performance.

However, I don’t find that to necessarily be true. The client that I mentioned above that sees incredible results from his email cross sell campaign does not have a segmented list. The emails are seasonal and relevant to their audience. They have catchy subject lines and always have a bit of fun information in them. We never, ever use a subject line as clickbait.

4. Craft Compelling Subject Lines

Subject lines are a most important part of strong email campaigns. They set expectations. Keep them clear, relevant, and benefit-oriented to improve your open and click-through rates.

Smart Content Ideas for Insurance Email Marketing

To build trust and add value, deliver educational content and relevant information that your audience cares about. Aim for consistent communication so your agency stays top-of-mind without overwhelming recipients.

1. Welcome Emails for New Clients

Start the relationship strong. Create a lead-generation campaign and welcome sequence for your clients that opt-in to receiving the lead magnet.

2. Industry news

Monthly newsletters with industry news updates, and tips (e.g., seasonal policy reminders, regulatory changes). Go super light on the insurance industry updates. Don’t even talk about rate increases. Doing so encourages your policyholder to start thinking about shopping their policy.

3. Survey Emails

Ask for feedback or coverage interests. This boosts engagement and tells you what other lines of business they want you to write. (think… life insurance or wedding insurance)

4. Promotional Alerts

Introduce new insurance services or new lines of business that you’re writing

5. Seasonal Content

Works like a charm! Subject Line: Getting ready for fall road trips. Talk about local places your policyholders can go for fall festivals, apple picking, leaf peeping. Tie it back to making sure their auto, motorcycle, RV coverage is ready for the trip.

Automate to Save Time and Stay Consistent

Email automation—built into most email marketing platforms—enables:

- Drip campaigns for onboarding new clients

- Triggered emails based on policy milestones or life events

- Periodic re-engagement messages if a client hasn’t interacted in a while

Leverage your agency management system or CRM data to fuel automation. This keeps your touchpoints relevant, information‑driven and timely.

Measure and Optimize Your Marketing Efforts

Track key metrics like open rates, conversion rates, and campaign performance to drive continuous improvement. Use data‑driven insights from your email platform. Audit your marketing campaigns once per quarter.

Constant iteration helps refine your marketing strategy and ensures you’re resonating with your target audience.

- Test alternative subject lines

- Adjust content frequency

- Monitor which email campaigns convert best

Best Practices in Insurance Email Marketing

- Compliance matters: Always respect CAN-SPAM rules

- Respect privacy and maintain opt-out functionality

- Use plain layouts and strong call to action (e.g., “Review your policy now”)

- Keep templates mobile‑friendly and aligned with your branding

- Avoid common pitfalls—manage frequency and relevance to prevent unsubscribes

- Shorter subject lines of 30–35 characters often yield higher open rates

Email Marketing Statistics for Insurance Agents

Industry‑specific benchmarks

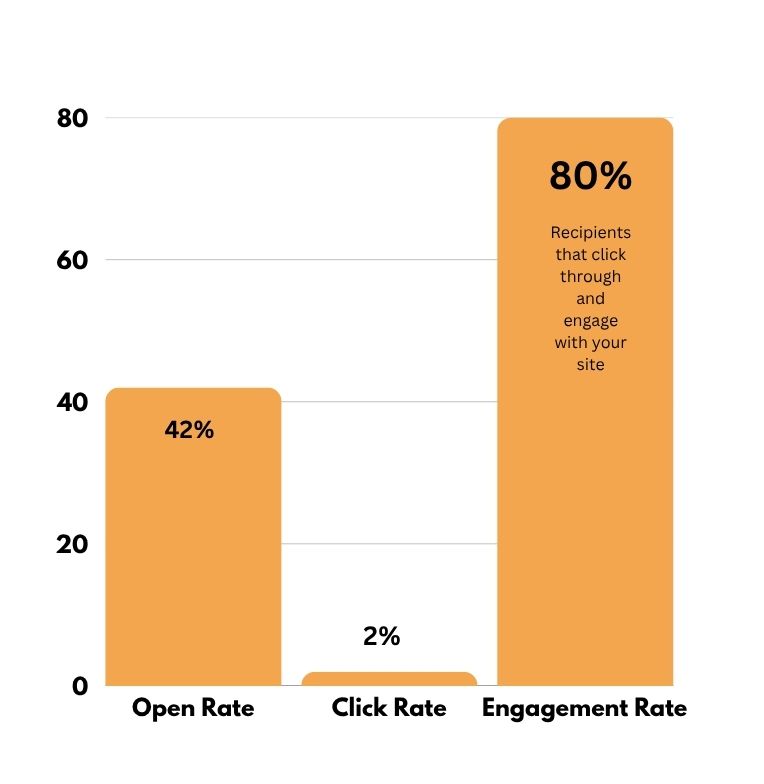

According to Mailchimp and Campaign Monitor data, the average open rate for the insurance sector is roughly 21.3%, with a click-through rate (CTR) of about 2.13%; unsubscribe rates remain low at around 0.25% and hard bounces near 0.67%.

Comparison to overall averages

Across all industries, average open rates hover around 19–21% and CTRs around 2.4%, confirming that insurance marketing campaigns perform on par with wider benchmarks.

Engagement trends in 2025

Platforms like MailerLite report that insurance email click rates hover around 1.79%, while the average open rate across all industries has increased to roughly 29–30%, highlighting rising engagement expectations across the board.

Why engagement matters

Open rates reflect how compelling your subject line and brand trust are, while CTRs (click-through-rate) indicate whether your copy and call to action motivates action. These email metrics are the most important for driving quote form completions from insurance clients and potential customers. The CTAs (call to action) should be strategic to driving business to your core lines of business and support your overall agency goals.

Once the recipient clicks through, they should be engaging with your site by clicking through to other pages via internal links and ultimately, quote form completions (see graph above).

Why Insurance Agents Should Master Email Marketing

A successful email marketing strategy serves as a pillar in marketing for insurance agencies—tapping into both new and existing policyholders with relevant content, professional tone, and smart automation.

From choosing the right email marketing software to measuring performance and refining campaigns, your agency gains a scalable pathway to customer retention, referrals, and enhanced insurance sales.

With consistent communication, educational content, and strategic email marketing campaigns, insurance agents can position themselves as trusted advisors and grow steadily in the digital age.

Ready to take your agency’s email marketing to the next level? Go Stack Media helps insurance professionals build results-driven campaigns that get opened, clicked, and convert. Let’s talk about YOUR email strategy today.

FAQ: Email Marketing for Insurance Agencies

How often should insurance agents send emails to clients?

Most agencies benefit from sending emails at least once a month to stay relevant without overwhelming subscribers. The key is consistency and quality over frequency.

What’s the best type of content to include in insurance email campaigns?

Educational tips, minimal policy updates, seasonal content, and client success stories work well. Keep it client-focused and actionable.

Which email marketing platform should I use?

Platforms like Constant Contact, Mailchimp, and Kit (formerly ConvertKit) are popular with insurance agents. Look for features like CRM integration, automation, and segmentation.

How do I grow my email list ethically?

Use opt-in sign up forms on your website and always get permission before sending marketing emails. Offering a valuable resource in exchange (like a coverage checklist) is a great incentive.

What performance metrics should I track?

Focus on open rates, click-through rates, and conversion rates—these tell you how effective your subject lines, content, and call to action are.