Table of Contents

TL;DR

- Not all leads are equal—quality, intent, and speed matter more than volume.

- The best property and casualty (P&C) leads are generated through your owned digital channels like SEO for your website, content for your website, PPC ads, and email newsletter—not purchased from vendors.

- This guide shows how to evaluate lead sources, where to find them, how to build your funnel, and the compliance guardrails to watch.

- We don’t sell leads. Go Stack Media helps your insurance agency generate high-quality P&C demand through SEO, content marketing, paid search, email, CRO, and analytics.

- Find a term glossary below.

90-Day Implementation Snapshot (Weeks 0–12):

- Look at your existing keyword opportunities by line of business (LOB) and state. (Audit)

- Launch PPC campaigns for high-intent quote searches. (Google display ads)

- Publish 3–5 cluster content assets tied to commercial/personal LOBs. (Content-Blog + Service Pages)

- Activate retargeting + email nurture broadcasts. (Email newsletter)

- A/B test landing pages, forms, and CTAs. (CRO-conversion rate optimization)

- Track CPL (cost per lead), close rate, and ROI by channel.

What Are Property and Casualty Insurance Leads?

Property and casualty insurance leads are individuals or businesses looking for coverage to protect physical assets (property) or liability exposure (casualty).

P&C Lines of Business

- Personal Lines: Homeowners, flood, renters, auto, motorcycle, umbrella

- Commercial Lines: General liability, professional liability, commercial property, BOP, commercial auto, workers comp, E&O

Buyer Journey

Most P&C buyers move through this sales process:

- Awareness: “Do I need commercial property insurance?”

- Research: “Best commercial insurance for contractors”

- Evaluation: Quote tools, side-by-side comparisons

- Action/Decision: Contact an agent, submit a quote request

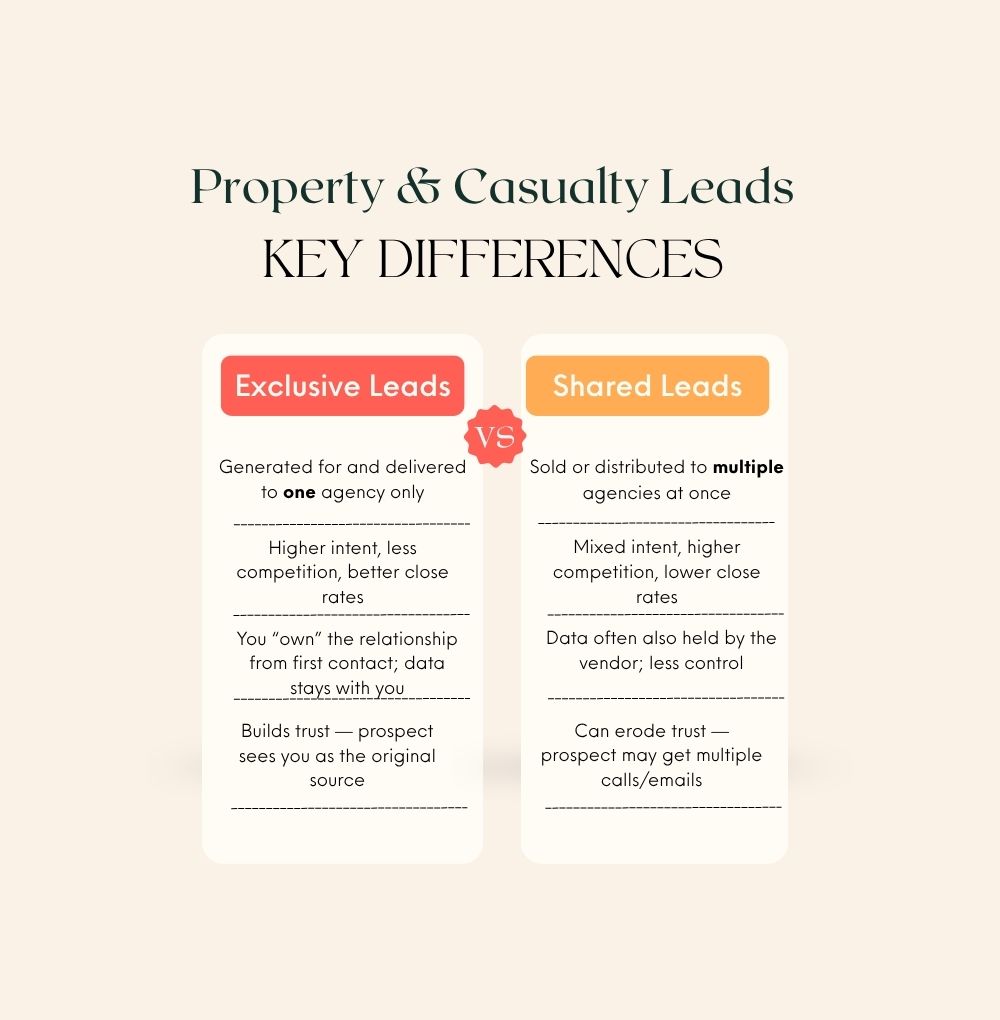

Exclusive vs. Shared Leads (Important Distinction)

- Exclusive leads are generated for and delivered to a single insurance agency or firm. These high quality leads have a higher intent and close rate. Think: Specifically looking for insurance and are ready to buy or actively doing research.

- Shared leads are sold to multiple buyers. Lower quality, faster burn rate. Think: “Can I get minimum limits?” or, “Why do I need $500k liability for my home insurance”

Go Stack Media helps agency owners build systems to generate exclusive-quality inbound leads from your own digital footprint.

How To Evaluate Best Lead Sources

The best lead source for qualified prospects depends on a mix of quality, intent, scalability, and compliance. Use these criteria to evaluate:

1. Quality Signals

- Real contact info (phone/email), recency

- Signal of urgency (e.g. quote request, call, live chat)

2. Buyer Intent

- Did they search “[state] liability insurance quote”? That’s high intent

- Did they download a risk checklist? Lower intent but nurture-worthy

3. Compliance & Consent

- TCPA consent must be captured if calling/texting

- GDPR/CCPA if dealing with personal data in regulated markets

4. Speed-to-Lead

- Contacting within 5 minutes boosts close rates significantly. Even if it’s an auto response

5. Scalability & ROI

- Does this source scale without spiking Cost Per Lead?

- Are you tracking Life Time Value and payback period?

Top Channels for P&C Insurance Leads: The Shortlist

Each of these channels can generate high-quality P&C leads. The key is to align the channel with buyer intent and your internal capacity.

Think: Meeting the client wherever they are on their buying journey.

SEO (Search Engine Optimization)

Overview: Build visibility for high-intent keywords like “general liability insurance in Austin, Texas”.

Tactics:

- Topical maps by LOB and geography

- State-specific service pages

- Local SEO: Google Business Profile, reviews, citations

- Content clusters (e.g. professional liability insurance + subpages for industries, like accounting, healthcare, tech, consulting, etc)

Go Stack Media helps by:

- Auditing your site

- Building keyword maps

- Publishing optimized content

- Running reports and analytics to monitor what’s working and what to cut

Content Marketing

Overview: Educate and attract with helpful tools and content.

Tactics:

- Blog

- Risk assessment checklists

- Coverage comparison guides

- How-tos

- Industry-specific landing pages

- Downloads pop-ups to activate email nurture sequences

PPC / Google & Bing Ads

Overview: Capture clients searching for insurance and ready to buy RIGHT NOW.

Tactics:

- High-intent keywords: “commercial property insurance quote near me”

- SKAGs (Single Keyword Ad Groups) or themed ad groups

- Enticing ad creative

- Performance Max (test carefully; can dilute spend)

Landing Pages:

- Simple, clean design, fast load

- Trust elements (badges, reviews)

- Quote/Lead forms with text fields

Paid Social

Overview: Reach targeted audiences or retarget prior visitors

Tactics:

- LinkedIn: Target commercial buyers by job title, industry, company size

- Meta: Retarget website visitors; run lead form ads for personal lines

Email Marketing & Marketing Automation

Overview: Nurture contacts who aren’t ready to buy now.

Tactics:

- Sequences

- Lead scoring by behavior

- Drip campaigns by LOB

- Re-engagement sequences

- Monthly newsletters to stay top of mind

Conversion Rate Optimization (CRO)

Overview: Turn more of your traffic into potential clients.

Tactics:

- Strategic CTA placement, A/B testing on headlines and subject lines, forms

- Sticky forms, quote flows

- Live chat or chatbot integration

- Page speed improvements

Partnerships & Co-Marketing

Overview: Access new audiences via shared authority.

Tactics:

- Webinars with real estate or construction associations

- Co-branded guides with trade groups

- Email swaps with local chambers

- Link swapping in website blog content

Directory / Marketplace Presence

Overview: Increase visibility but vet carefully.

Use selectively:

- Claim profiles on local or industry directories

- Avoid shared-lead marketplaces unless highly qualified and transparent

Budgeting & Forecasting Framework

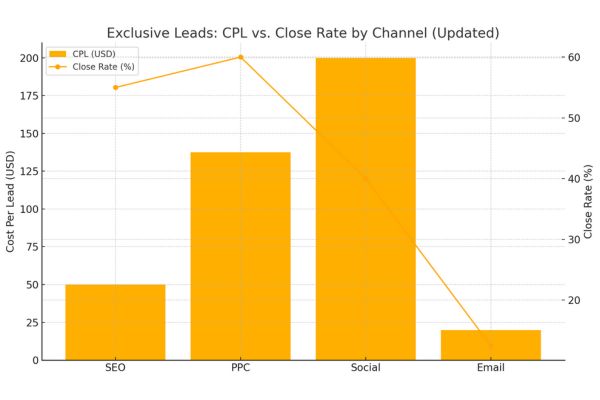

| Channel | CPL Range | Time-to-Lead | Close Rate |

| SEO | $50 | 3–9 months | 50-60% |

| PPC | $75-$200 | Immediate | 50-70% |

| Social | $100–$300 | Immediate | 20-40% |

| $20 (nurtured) | Immediate | 5–20% |

Sample Forecast

- Monthly spend: $7,000 across PPC + SEO

- Leads: 70 (avg CPL $100)

- Close rate: 40%

- New clients: 28

- Avg policy premium: $1,200

- New Business Premium: $33,600

- Begin email cross-sell campaigns for sticky client effect

- 200%+ ROI over lifetime

Compliance & Consent

TCPA, GDPR & First-Party Data

Glossary below

- Use clear consent checkboxes on all forms

- Maintain records of opt-in, timestamps, and source

- Avoid 3rd-party data scraping; prioritize first-party capture

Analytics Stack

- GA4 with conversion events

- Call tracking

- CRM + marketing automation sync

- Use UTM parameters and campaign naming conventions

Case Study Snapshots (Anonymized)

Case 1: Commercial Lines Focus

- Client: Multi-location agency in the Southeast

- Challenge: Inconsistent inbound lead volume

- Solution: Built out geo-targeted landing pages + local listings

- Result: 60% lift in organic lead flow, with 12% close rate

Case 2: Personal Lines & Local SEO

- Client: Regional agency in the Southeast

- Challenge: Reliant on vendor leads with high CPL and low close rate

- Solution: Launched SEO + GoogleAds (PPC) campaign targeting home insurance

- Result: +5X increase in qualified leads, CPL dropped from $380 to $80

90-Day Implementation Snapshot (Weeks 0–12):

- Look at your existing keyword opportunities by line of business (LOB) and state. (Audit)

- Launch PPC campaigns for high-intent quote searches. (Google display ads)

- Publish 3–5 cluster content assets tied to commercial/personal LOBs. (Content)

- Activate retargeting + email nurture flows. (Email newsletter)

- A/B test landing pages, forms, and CTAs. (CRO-conversion rate optimization)

- Track CPL (cost per lead), close rate, and ROI by channel.

Own Your Pipeline. Outperform the Market.

If you’re tired of chasing low-quality leads and ready to build a demand engine you actually own, you’re in the right place. At Go Stack Media, we help P&C insurance teams create consistent, scalable, high-converting pipelines using proven SEO, content, PPC, and email strategies. No lead lists. No middlemen. Just results.

Get a free 90‑Day Plan tailored to your market, goals, and line of business.

Glossary: Key Terms

P&C (Property & Casualty): Insurance covering physical assets and liability risks

LOB (Line of Business): Category of insurance product (e.g. commercial auto)

Inbound Lead: Prospect who initiates contact or expresses interest

Exclusive Lead: Sent to one agency; not sold to competitors

Shared Lead: Sold to multiple agencies; lower intent

First-Party Data: Info collected directly from your audience (e.g. email, site visit)

CPL (Cost Per Lead): Total ad or marketing spend divided by leads generated

Lead Scoring: Assigning value to leads based on behavior and fit

Marketing Automation: Software that triggers marketing actions based on user behavior

Performance Max: Google Ads campaign type using AI to serve ads across placements

Conversion Rate Optimization (CRO): Increasing the % of visitors who become leads

TCPA: U.S. law governing how companies can contact consumers via phone/SMS

SEO: Search Engine Optimization ICP: Ideal Customer Profile

Frequently Asked Questions

How fast will I see results?

PPC can generate leads within days. SEO and content may take 3–9 months to gain traction and is an important part of the lead generation process.

What is a good CPL for P&C leads?

Anywhere from $80–$200 is common. It depends on the line of business, geographic area, and agency close rates.

What tools do I need to run campaigns?

Google Ads, a CRM, email marketing tools (Mailchimp and Google Analytics are necessary).

Can I generate leads without buying from a vendor?

Yes. With SEO, content, paid ads, and nurturing you can build a predictable pipeline that you can count on.

Should I run separate funnels for personal vs. commercial lines?

Yes. Buyer intent, content, and targeting are different. Separate your landing pages, campaigns, and follow-ups.

How do I ensure TCPA compliance?

Get consent for emails. Keep logs of opt-in timestamps and user source.

Is LinkedIn worth it for insurance?

Yes— for commercial lines. You can target by job title, company size, and industry.

Should I use Performance Max?

Test cautiously. It can work for high-volume markets, but you lose control over placements and creative.

How do I nurture leads that aren’t ready to buy?

Use email sequences with value-first content, drip campaigns, and re-engagement triggers.

Can I track ROI by channel?

Yes—set up UTM parameters, use call tracking, and map lead source through your CRM.