Table of Contents

In the digital age, having an online presence is essential for any business, including insurance agencies.

Blogging is a powerful tool that can help you connect with potential clients, establish authority in the industry, and improve your website’s visibility on search engines (Google, Bing, Yahoo!, etc).

However, starting a blog can seem daunting, especially if you’re unfamiliar with SEO, content creation, or digital marketing.

If you’re new to blogging, don’t worry—this simple guide will walk you through the benefits of insurance blogs and how you can start creating content that drives results.

What is Blogging?

Before diving into the benefits of blogging it’s important to understand what blogging actually is.

At its core, blogging is the act of creating and publishing content on a website, typically in the form of written articles or posts.

These posts can cover a wide range of topics, from industry insights and how-to guides to personal stories and news updates.

For an insurance agency, blogging serves as a way to communicate with potential and existing clients in a more personal and informative manner.

Unlike the more formal pages on your website that detail your services and policies, a blog allows you to explore topics in depth, answer common questions, and provide valuable advice that can help clients make informed decisions about their insurance needs.

Blogging isn’t just about writing, though. It’s also about connecting with your audience. Through your blog, you can engage with readers by encouraging comments, sharing posts on social media, and responding to feedback.

This interaction helps build trust and loyalty, making your blog an essential tool for growing your business in today’s digital landscape.

The Benefits of Insurance Blogs

1. Improve Search Engine Ranking

One of the biggest advantages of maintaining an insurance blog is improving your website’s search engine optimization (SEO). When you consistently publish high-quality content on your website, search engines like Google, Bing, and Yahoo! are more likely to rank your site higher in search results.

For insurance agencies, this means potential clients will be able to find you when they are looking to get their questions answered like, “Why did my car insurance go up without an accident?” Or, Does roof type affect my home insurance rate?”

Optimizing your insurance blog with relevant keywords, like type-of-insurance and location-based terms, will increase your chances of showing up when people are actively searching for solutions.

To make the most out of your blog, focus on topics that are frequently searched. For example, if you notice that potential clients often ask questions like “What type of insurance do I need?” or “How can I lower my insurance premium?” Those are great subjects to address in your posts.

Make sure each post answers a question or solves a problem to help build trust with your audience.

2. Establish Authority in the Insurance Industry

When people look for insurance, they’re not just buying a policy—they’re looking for guidance and expertise.

One of the main reasons insurance blogs are so effective is that they allow you to position yourself as an authority in the field.

By regularly sharing industry insights, offering advice, or explaining complex insurance terms, you can demonstrate your knowledge and experience.

This makes potential clients more likely to trust your expertise when it comes time to choose an insurance provider.

For example, you might publish posts like “The Complete Guide to Understanding Homeowners Insurance” or “Top Tips for Finding Affordable Health Insurance.”

pssst… these can also be used as a lead magnet to grow your email list.

As you publish more content, your blog will serve as a valuable resource where clients can turn to for answers, further solidifying your role as a leader in the industry.

3. Engage With Clients

Insurance blogs provide a unique platform to engage with your audience on a more personal level.

This interaction can help build relationships with both current clients and prospects, fostering a sense of community around your agency.

Encourage readers to leave comments or ask questions on your blog posts, and be sure to respond promptly.

This two-way communication shows that you’re not just an insurance provider but also someone who cares about your clients’ concerns.

Additionally, you can use your blog to showcase client testimonials, case studies, or success stories. This adds a personal touch and can help reassure prospects who are on the fence about signing up for a policy.

4. Generate Leads

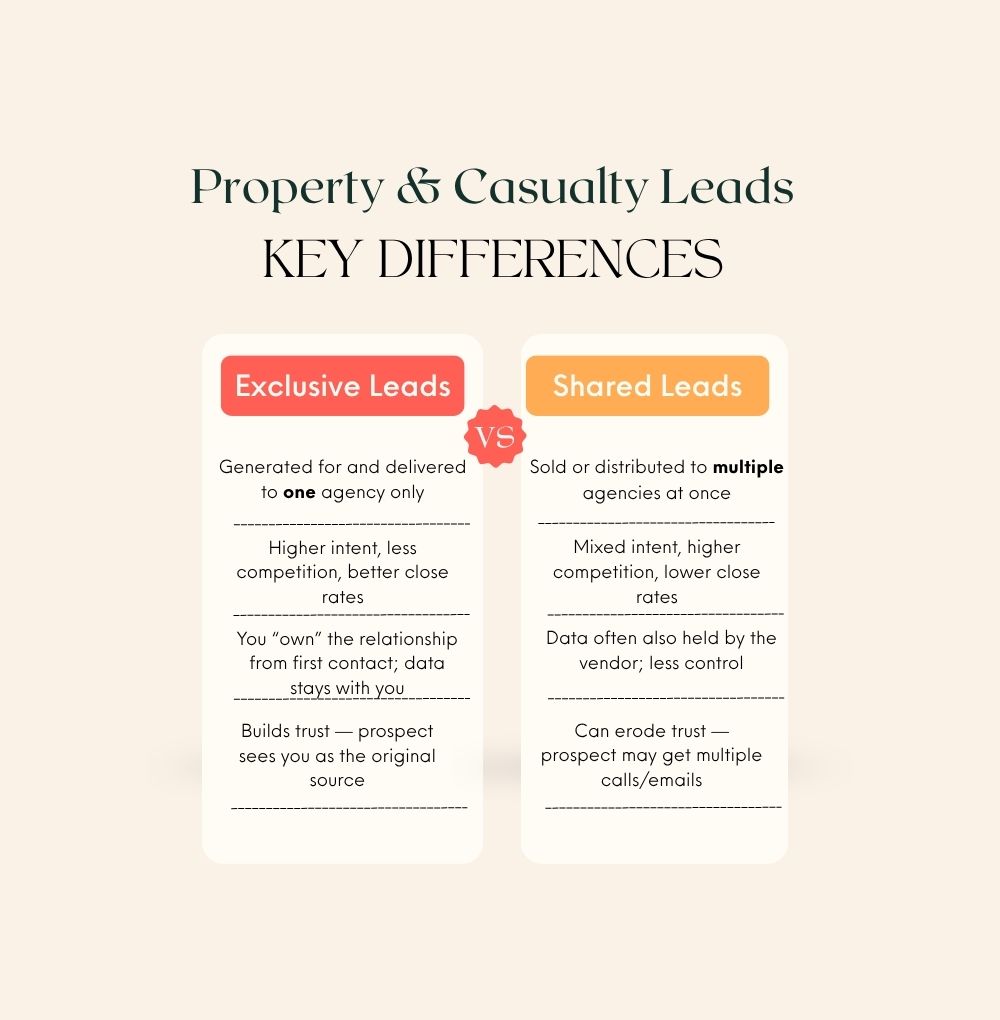

If you’re currently paying for leads, it’s time to reconsider your strategy.

Many of the lead generation websites you’re competing with are using their blogs to drive traffic—and you can do the same.

By optimizing your insurance blog with targeted keywords, you can generate high-quality leads on your own, reducing the need to buy leads from third parties. For example, blog posts like “How to Choose the Best Life Insurance Policy” or “5 Ways to Lower Your Car Insurance Premium” can attract potential clients who are actively searching for solutions.

By providing helpful information, you can guide them through their research process and encourage them to reach out for more personalized advice.

Additionally, include clear calls-to-action (CTAs) at the end of your posts to convert visitors into leads. Whether it’s signing up for a newsletter, downloading a free guide, or requesting a quote, make sure your CTAs are easy to follow and aligned with your marketing goals.

5. Increase Website Traffic

More blog posts mean more opportunities for people to find your website. When your insurance blog covers a wide range of topics—from the basics of insurance to more niche areas—you create multiple entry points for potential clients to discover your services.

For example, someone searching for information on renters insurance may come across your blog post “What Does Renters Insurance Cover?” and from there, they may explore other services you offer, such as home or auto insurance.

As you continue to publish new posts, you’ll see an increase in organic traffic, bringing more visitors to your site and expanding your reach.

Additionally, insurance blogs give you the chance to rank for long-tail keywords, which are more specific searches like “best car insurance for new drivers” or “how to insure a small business.”

By targeting these niche queries, you can attract highly motivated prospects who are further along in their decision-making process.

How to Start Writing Insurance Blogs

Now that you know the benefits of maintaining an insurance blog, it’s time to start writing. If you’re unsure where to begin, here are some tips to get you started:

1. Identify Key Topics

Start by brainstorming a list of topics that address common questions or concerns your clients might have. Think about the questions you often receive over the phone or via email, and use those as inspiration for your blog posts.

For example, you could write posts like:

- “What Type of Insurance Does My Business Need?”

- “How to File an Auto Insurance Claim After an Accident”

- “Understanding the Difference Between Term and Whole Life Insurance”

2. Focus on SEO

When writing your posts, be sure to incorporate relevant keywords that your potential clients might be searching for. This includes phrases like “insurance blogs,” “affordable insurance,” or specific services like “commercial umbrella insurance.”

However, avoid keyword stuffing—make sure your content flows naturally and provides value to the reader.

Additionally, don’t forget to optimize your blog titles, meta descriptions, and headings for SEO. This will improve your chances of ranking higher in search engine results pages (SERPs).

3. Keep it Consistent

The key to a successful insurance blog is consistency. Set a schedule that works for you—whether it’s posting weekly, bi-weekly, or monthly—and stick to it.

Consistently publishing new content will help improve your website’s SEO and keep your audience engaged.

Learn How to Write Insurance Blogs

Starting an insurance blog may seem like a lot of work, but it’s one of the best ways to grow your business, connect with potential clients, and boost your visibility online.

The good news? You don’t have to be a professional writer or SEO expert to get started.

So why not give it a shot? Start brainstorming a few ideas (we’ve given you about a dozen in this post), write from your own experience, and remember—your blog is a tool to help people.

Ready to start writing your own insurance blog? Get in touch if you have questions, and I’ll be happy to help!